All Categories

Featured

Table of Contents

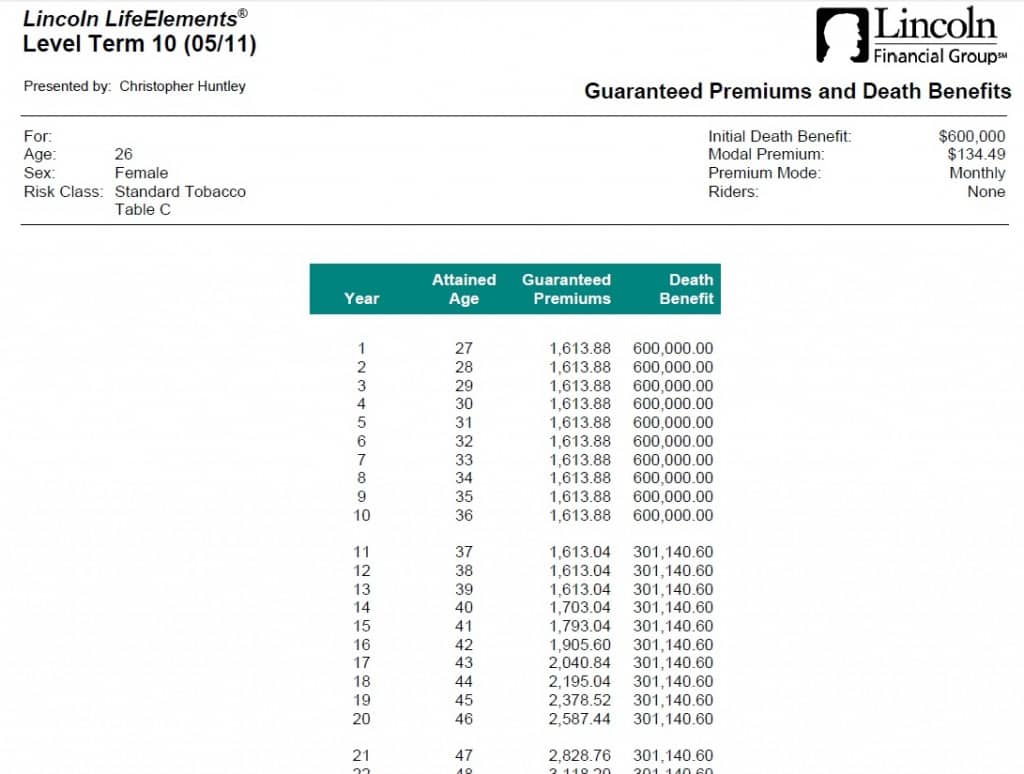

That normally makes them a more budget friendly option forever insurance coverage. Some term plans may not keep the costs and survivor benefit the very same in time. You do not wish to mistakenly believe you're acquiring level term coverage and afterwards have your death advantage adjustment later. Many individuals obtain life insurance policy protection to help financially safeguard their enjoyed ones in situation of their unforeseen death.

Or you might have the option to convert your existing term protection into an irreversible plan that lasts the remainder of your life. Different life insurance policies have prospective advantages and downsides, so it's vital to recognize each before you decide to buy a policy.

As long as you pay the costs, your beneficiaries will certainly obtain the survivor benefit if you pass away while covered. That stated, it is necessary to keep in mind that many plans are contestable for two years which means insurance coverage can be rescinded on fatality, must a misrepresentation be located in the app. Plans that are not contestable commonly have a graded survivor benefit.

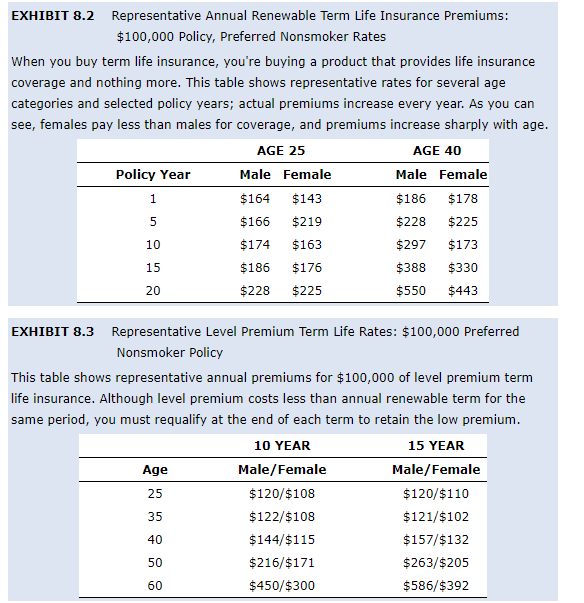

Premiums are generally less than whole life plans. With a level term policy, you can pick your insurance coverage quantity and the policy length. You're not locked right into an agreement for the rest of your life. Throughout your policy, you never ever have to fret about the costs or fatality advantage quantities changing.

And you can't pay out your plan throughout its term, so you will not get any monetary benefit from your past insurance coverage. As with other sorts of life insurance policy, the price of a degree term plan relies on your age, coverage demands, work, lifestyle and health. Normally, you'll locate much more affordable insurance coverage if you're younger, healthier and less risky to insure.

Long-Term A Term Life Insurance Policy Matures

Since level term costs remain the exact same for the period of protection, you'll recognize precisely just how much you'll pay each time. Degree term insurance coverage also has some adaptability, enabling you to tailor your plan with additional attributes.

You might have to satisfy particular conditions and qualifications for your insurer to enact this motorcyclist. There also can be an age or time restriction on the protection.

The fatality advantage is commonly smaller sized, and protection typically lasts till your child turns 18 or 25. This rider may be a much more economical means to assist guarantee your youngsters are covered as motorcyclists can commonly cover numerous dependents simultaneously. As soon as your youngster ages out of this insurance coverage, it may be feasible to transform the motorcyclist right into a new policy.

The most usual type of long-term life insurance is whole life insurance coverage, however it has some vital differences compared to level term coverage. Below's a basic overview of what to consider when contrasting term vs.

Affordable Guaranteed Issue Term Life Insurance

Whole life insurance lasts insurance policy life, while term coverage lasts protection a specific periodCertain The premiums for term life insurance are generally lower than whole life insurance coverage.

Among the major attributes of degree term insurance coverage is that your premiums and your survivor benefit do not alter. With lowering term life insurance coverage, your premiums remain the very same; however, the death benefit quantity obtains smaller over time. For instance, you may have protection that begins with a fatality advantage of $10,000, which can cover a mortgage, and after that yearly, the survivor benefit will reduce by a set quantity or percent.

Due to this, it's usually a much more budget-friendly type of level term coverage., however it may not be sufficient life insurance policy for your needs.

After choosing on a plan, complete the application. For the underwriting procedure, you may have to give basic individual, health and wellness, lifestyle and work information. Your insurance firm will determine if you are insurable and the risk you might offer to them, which is shown in your premium prices. If you're authorized, sign the documents and pay your first premium.

Leading A Whole Life Policy Option Where Extended Term Insurance Is Selected Is Called

You might desire to upgrade your recipient info if you've had any considerable life changes, such as a marital relationship, birth or divorce. Life insurance can sometimes really feel complex.

No, level term life insurance doesn't have cash value. Some life insurance policy plans have an investment function that enables you to construct cash worth in time. A portion of your costs settlements is alloted and can make passion over time, which expands tax-deferred during the life of your protection.

These plans are often significantly much more costly than term protection. If you reach the end of your policy and are still alive, the coverage finishes. You have some alternatives if you still want some life insurance policy coverage. You can: If you're 65 and your protection has run out, for instance, you might wish to acquire a brand-new 10-year level term life insurance policy policy.

Joint Term Life Insurance

You might have the ability to convert your term insurance coverage into an entire life policy that will certainly last for the rest of your life. Lots of types of level term plans are convertible. That means, at the end of your insurance coverage, you can transform some or all of your plan to whole life coverage.

Level term life insurance coverage is a plan that lasts a collection term typically between 10 and 30 years and includes a level death advantage and degree costs that stay the very same for the entire time the policy holds. This indicates you'll recognize exactly just how much your settlements are and when you'll have to make them, permitting you to budget appropriately.

Degree term can be a fantastic choice if you're aiming to purchase life insurance policy coverage for the very first time. According to LIMRA's 2023 Insurance policy Barometer Study, 30% of all grownups in the U.S. demand life insurance and do not have any kind of type of policy. Level term life is predictable and budget-friendly, which makes it one of one of the most popular sorts of life insurance policy.

Latest Posts

Selling Final Expense Life Insurance

Omaha Funeral Insurance

Best Final Expense Companies